Dark Cloud Cover in Candlestick Trading

Contents

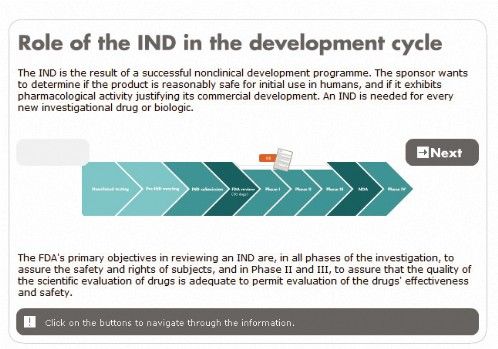

This sentiment is also carried on to the opening of the next day as the market gaps up. The buying pressure continues to make to market to go higher. Every candlestick has its own meaning and tells a unique story about what the market has been up to. It stands to reason that when the pattern forms the reversal happens. We all know that patterns set up and break down all the time. When you zoom in you see the smaller patterns like the darkcloud coverpatterns forming.

I have many years of experience in the forex industry having reviewed thousands of forex robots, brokers, strategies, courses and more. I share my knowledge with you for free to help you learn more about the crazy world of forex trading! One of the popular ways to utilize the Dark Cloud Cover is to trade on the range or trending markets. Although the pattern can appear frequently, I believe that I useful way is to look for the Dark Cloud Cover on longer timeframes for more reliable data.

Full BioSuzanne is a content marketer, writer, and fact-checker. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

The candle formation shows sunny days but all of a sudden dark cloud covers the horizon and darkens the scenario. It’s important to remember that the dark cloud cover pattern is only applicable to candles with large bodies. Smaller candles with larger wicks often aren’t strong enough to drive a momentum shift. Larger-bodied candles suggest a more decisive move down, which can be a significant factor in predicting price trends. The reliability of the dark cloud cover pattern depends on the place of its appearance on a price chart.

Often times, the larger the upside gap, the more powerful the potential reversal will be. To reach the desired outcome, the pattern must occur within the trend. Also the larger the gap between the closing price of P1 and the opening price of P2, the stronger will be the reversal. Here, the first candle or the P1 candle is part of the continuing uptrend and the bulls are dominating. Here the pattern shows a turnaround from a bullish market to a major bearish market ahead. The pattern is mainly used to indicate when the uptrend might come to an end and is more likely to shift towards a downtrend.

Bearish Abandoned Baby Candlestick Pattern – Definition, Meaning & Trading Strategies

Else, during the highly volatile market scenario, or in eventful choppy markets, such signals should be avoided. On such days, the price movements deviate from the expected path. Candlestick chart patterns are known to generate false signals when all conditions are not met. A trader must also see to the fact that all preconditions are rightly in place. The trader may sell/ create a short position on the stock on the third day, just below the price of the close of P2.

However, this pattern is not followed by a confirmation candlestick . If entering short, the initial stop loss could be placed above the high of the bearish candle. Following the confirmation day, the stop loss could be dropped to just above the confirmation day high in this case. Traders would then establish a downside profit target, or continue to trail their stop loss down if the price continues to fall.

- These are just some of the technical methods that can be used alongside the dark cloud cover formation.

- If the pattern managed to reverse an uptrend, its second candle creates a strong resistance zone.

- Both of these patterns are reversal candlestick structures.

- Hence, the candlestick patterns give us a probable but potential price action move shortly.

A trader may also look for a breakdown from an important level of support after a chartschool as an indication that a downtrend may be on the way. Further, the pattern is characterized by black and white candlesticks that have long real bodies and short or absent shadows. These qualities mean that the lower move was both significant and highly decisive in terms of the movement of price. Also look for a confirmation in the form of a bearish candle in the pattern. The price is expected to decrease after the dark cloud cover.

Dark Cloud Cover in Candlestick Trading

With a moving average applied to the chart, we can easily see whether the price is below or above the average, and choose to only act on signals where we have an up-trend. At that stage, selling pressure adds up as more investors start becoming worried that the market isn’t as strong as they believed. More and more people start selling their positions, and the market closes below the midpoint of the preceding candle. Chart patterns are made up of candlesticks showing a tug of war between buyers and sellers. This tug of war forms patterns that allow us to gauge how other traders are feeling. A trader – depending on his risk appetite – can short sell immediately after the confirmation or once the price falls below the low of the first green candle.

As prices increase, the pattern becomes more beneficial for marking a potential move to the downside. If the price action is choppy the pattern is less important since the price will probably remain choppy after the pattern. Three outside up/down are patterns of three candlesticks on indicator charts that often signal a reversal in trend. He has been a professional day and swing trader since 2005. Cory is an expert on stock, forex and futures price action trading strategies.

The pattern is said to becoming more essential for the reversal to the downside as the prices rise. When the shift appears from buying to selling, the price reversal to downside takes place which is most likely to be forthcoming. You should place your stop loss above the high of the bearish candle. The bodies of both the initial candle and the dark cloud cover candle are very long. Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win.

The dark cloud cover is comprised of two candles, wherein the first candle is a bullish candle, with a relatively long body. The second candle gaps higher, but then reverses and closes below the halfway point of the body of the first candle. The bearish engulfing pattern is a somewhat similar pattern to dark cloud cover though their formations are different. But both are essentially bearish patterns and both show bearish trend reversals.

It is worth noting that because the trade is potentially the starting point of an extended move down, traders can set multiple target levels. The dark cloud cover pattern occurs fairly often, but it is essential to differentiate between a true dark cloud cover pattern and a simple long white candlestick. Below you can see an illustration of the dark cloud cover candlestick pattern. An easy way to learn everything about stocks, investments, and trading. Long traders may want to consider exiting towards the close of the bearish candle or the next day if the price continues to fall. There is the third candle in this combination which is red and follows these two candlesticks.

How to handle risk with the Dark Cloud Cover pattern?

It happens when there is a relatively small bullish candlestick that is completely engulfed by a bigger bearish candlestick. In most cases, the engulfing pattern will often lead to a reversal. Dark cloud cover technical analysis helps investors trade during bearish reversal followed by confirmation. First, the investors must identify a dark cover because there can be other phenomena resembling the cover, like bearish engulfing, shooting star, etc. Secondly, the investors can wait till the confirmation to make a selling decision. However, a cover is not always harmful, and the stock prices are likely to recover in a few days or weeks, provided the investor is in for the long run.

This is largely because the bearish candle of the cloud has a higher close compared to that of the bearish engulfing candle. Usually, a down candle follows an up candle, which shows that the prices have been reduced. However, if another down candle follows the existing down candle, the stock market gets confirmation that the market is bearish, and the fall in prices is likely to continue. The Harami pattern is a 2-bar reversal candlestick patternThe 2nd bar is contained within the 1st one Statistics to… The red candle closes below the middle of the previous green candle.

Another way to gauge the conviction of the market, is to look at candle ranges. By looking at the distance that buyers and sellers moved the market each candle, we get a sense of the general strength of the market. Require the volume of the pattern itself to be higher than that of surrounding bars. Please be advised that your continued use of the Site, Services, Content, or Information provided shall indicate your consent and agreement to our Terms and Conditions. The bulls push price higher at the open but the bears ultimately took over.

It foretells the change in sentiment, from bullish to bearish. The dark cloud cover is a two candle formation that is characterized as having reversal characteristics. More specifically, it is seen near the top of an uptrend, or near the top of a trading range.

Key Takeaways

With the first approach, you want to make sure that the dark cloud cover was formed with significantly more volume than the preceding bars in the uptrend. This shows us that many participated in forming the pattern. Another conclusion we could draw is that https://1investing.in/ the market now has had a major volume blow off, which traditionally is a sign of a coming reversal. As the first bullish candle of the pattern forms, we notice that the buying pressure is strong, and that buyers continue to support the rising trend.

Dark cloud cover is a stock market event that intricately studies the prices. The term ideally means that the tumbling prices resemble dark clouds. Before going into the depth of a bearish dark cloud cover, it is important to understand some concepts, which are also the basic requirements for the dark cover to occur. This makes it possible for traders to have a positive risk-reward ratio, which then gives them an edge even if the win rate is over 50 percent. But note that dark cloud cover pattern is very reliable and usually indicates a reversal.

Does the Dark Cloud Cover apply to all candlestick charts?

A confirmation for the dark cloud cover pattern comes in the form of a bearish candle at the end of the pattern. You need to know that the dark cloud candlestick pattern is a part of the Japanese candlesticks, and it signals that there might be trend reversal after the frequent rise in price. These candlestick charts are price chart that is mostly used in the technical analysis.

However, a conservative trader may wait for the exit, if the price continues to decline. The formation of the Dark Cloud Cover takes place when a bearish candle follows a bullish candle. The bearish candle opens above the close of the bullish candle and closes below the middle of the bullish candle. For example, if a dark cloud cover forms on a day you know has bearish tendencies, you might want to be careful with acting on the pattern. The bearish candle could very well have been amplified by the bearish tendency of that day to a degree where it accidentally formed the dark cloud cover pattern. On the fourth and fifth of April, PayPal stock made a dark cloud cover pattern.

If the price action is choppy the pattern is less significant since the price is likely to remain choppy after the pattern. The red bearish candle proceeds lower and closes below the midway point of the bullish candle, showing that the bears are outweighing the bulls at that level. The pattern is made of two candlesticks and can only occur in a bull market. Next, we want to ensure that the dark cloud cover occurs in the context of an uptrending market. It is difficult to know which of these two scenarios is likely to occur at the completion of the pattern. However, the price action should help us in gauging the more likely scenario.