8 Pros And Cons Of Using https://CreditScoresFinder.com Instant Online Payday Loans

Content

In that case, users are forced to take out another loan to keep up with their regular bills. Develop A Budget – Create a balance sheet with cash inflows and outflows. Knowing how much you have coming in and where you’re spending it is crucial to managing personal finances. For instance, cable is a good place to start eliminating expenses. Keep in mind that it is a serious mistake to borrow at high interest rates to pay regular monthly expenses.

- Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first.

- Any individual with a steady income can apply for this loan after answering some basic questions.

- Providing your customers with safe and secure credit is what keeps them coming back, but how can you protect your finances?

- Explore funding options and solutions to help protect your profits in the long-term.

- I never thought I would be the kind of person to be in a long distance relationship.

- A big plus payday loans have is the fact that you can receive the money in not more than 24 hours.

Personal loans often come with lower interest rates than credit cards. As of July 2022, the average personal loan rate was 10.28 percent, while the average credit card rate was 16.80 percent. Consumers with excellent credit history can qualify for personal loan rates in the range of 10.3 percent to 12.5 percent. You may also qualify for a higher loan amount than the limit on your credit cards.

Features And Benefits Of Opening A Demat Account

If you have poor credit or a short financial history, fewer lenders will be available to you. You’ll have to review the terms and interest rates on your current loans vs. a single payday loan, but in all likelihood there is no “pro” to going this route. Most payday loans charge exorbitant interest rates and severe penalties if payment terms are not met. This article will provide the steps you can apply for an online payday loan and what the requirements are and how long you’ll need to wait before receiving the money. As guaranteed, we will keep away from decisions while as yet calling attention to realities. We will likewise keep away from numbers since there are an excessive number of contrasts between moneylenders.

Pros And Cons: Payday Loans For Individuals With Credit Challenges

Without carefully planning https://CreditScoresFinder.com your finances, you run the risk of falling into a debt cycle, which isn’t cheap to get out of. A payday loan allows people with adverse credit, bad credit, County Court Judgements or CCJs, as well as those who have been declared bankrupt, to get an unsecured loan. Research shows some 80% of payday loans get rolled over or renewed within two weeks. Now, you should know, they’re unsecured, which is why they’re considered to be high risk for the lender, thus, they’re low-value, meaning that you might not be able to get more than 1.000 dollars. Find out the average interest rates on personal loans by lender and credit…

How Do Payday Loans Work?

According to a 2015 study by the Pew Charitable Trusts, 12 million Americans take out payday loans each year and spend $7 billion on loan fees. Though the interest rates commonly are disguised as fees, they effectively range from 300%-500% annual percentage rate . Payday loans — which are small, unsecured loans that don’t require collateral and have short terms — are a popular way for people to access cash fast. But in practice they end up costing borrowers a lot, so you need to know what you’re getting into. Before we take a look at all the pros and cons you might come across, it’s important that we mention what they are, which is especially useful if you’ve never applied for it before. To put it simply, these loans are short-term and unsecured, which means that you won’t have to use your assets – such as your house or car – as collateral if you’re unable to pay off the amount.

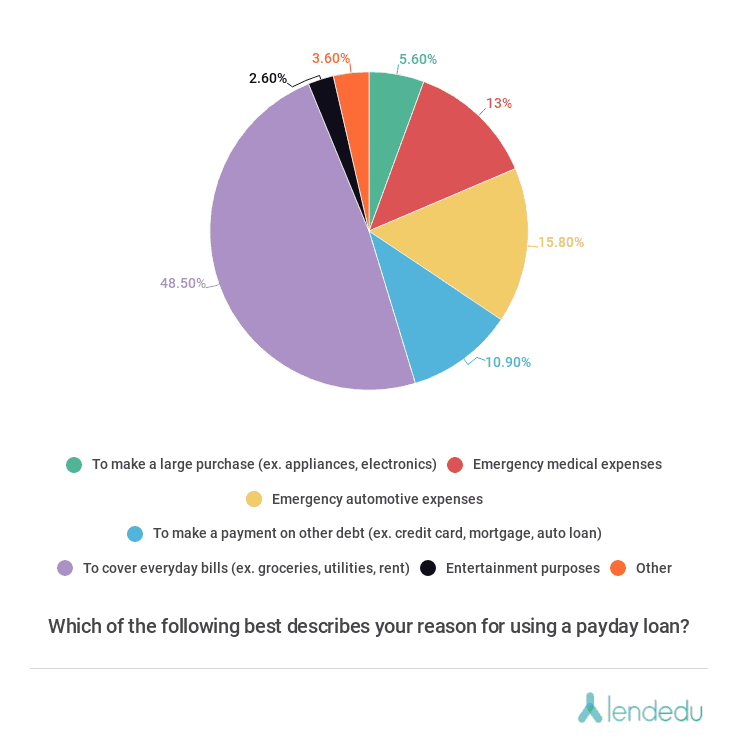

Payday loans can be very tempting, especially to those without cash reserves and less-than-sterling credit histories. But beware, just because a payday lender doesn’t seem to care about your credit worthiness doesn’t mean borrowing the money isn’t perilous. Payday lenders advertise on TV, radio, online and through the mail, targeting working people who can’t quite get by paycheck to paycheck. Though the loans are advertised as helpful for unexpected emergencies, seven out of 10 borrowers use them for regular, recurring expenses such as rent and utilities. Banks used to make those sorts of loans, called deposit advances, which were generally repaid quickly – often before a borrower’s next paycheck. But new banking rules ended the practice in 2014 after regulators warned that deposit advances sometimes led borrowers to crippling debt.

Applying For A Business Grant For The Disabled

A graduate of the University of Florida, Julia has four years of experience in personal finance journalism and specializes in covering money trends. Money’s Top Picks Best Credit Cards Cash back or travel rewards, we have a credit card that’s right for you. Because you get the loan payment all at once, it can be easier to make a large purchase, consolidate debt or otherwise use the loan all at once. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

You end up being caught up in a spiral of applying for one loan after another. And if the loan tends to be expensive or if you may seek difficulty in paying back on time the borrower often ends up applying for another loan to pay off the initial payday loan. Personal loan application processing and funding speeds vary, but many lenders advertise same- or next-day funding. So, if you’re facing unexpected auto repair costs or emergency travel needs, a personal loan may be feasible. Lenders disburse personal loans as a lump-sum upfront that you can use to make a purchase or pay off another debt. This enables borrowers to make large purchases and then pay for them over time, without saving money in advance.